Quick Take

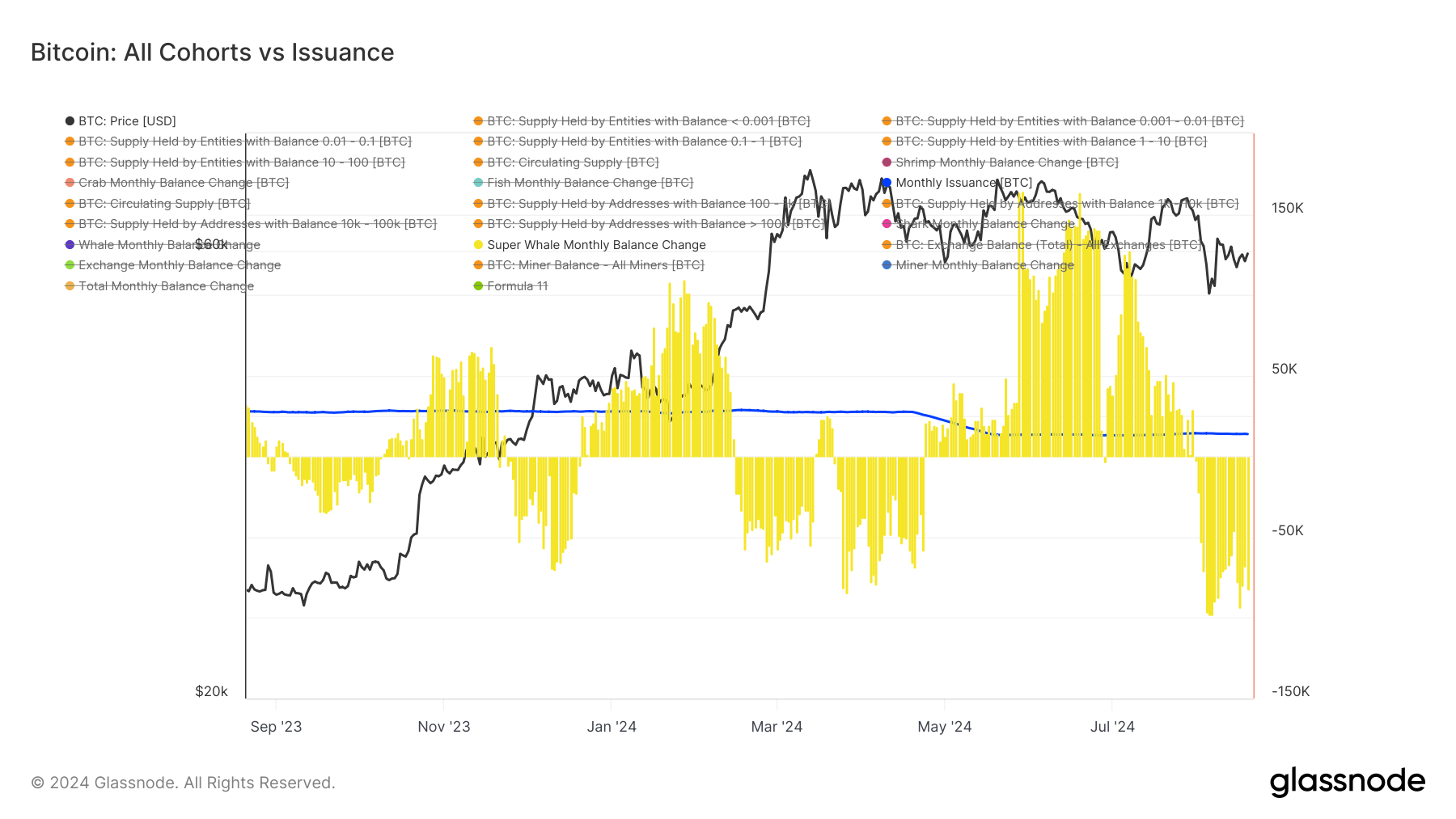

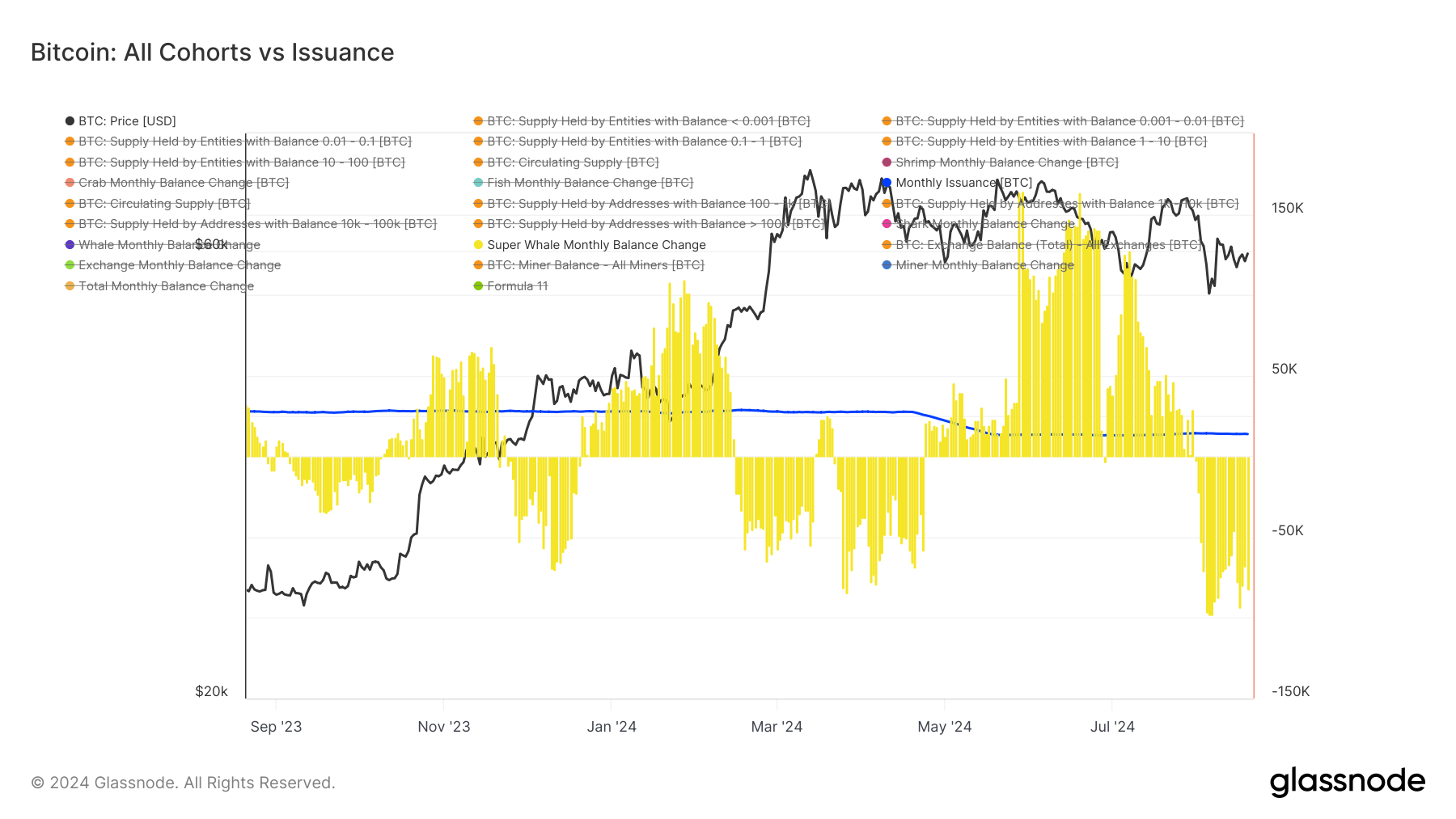

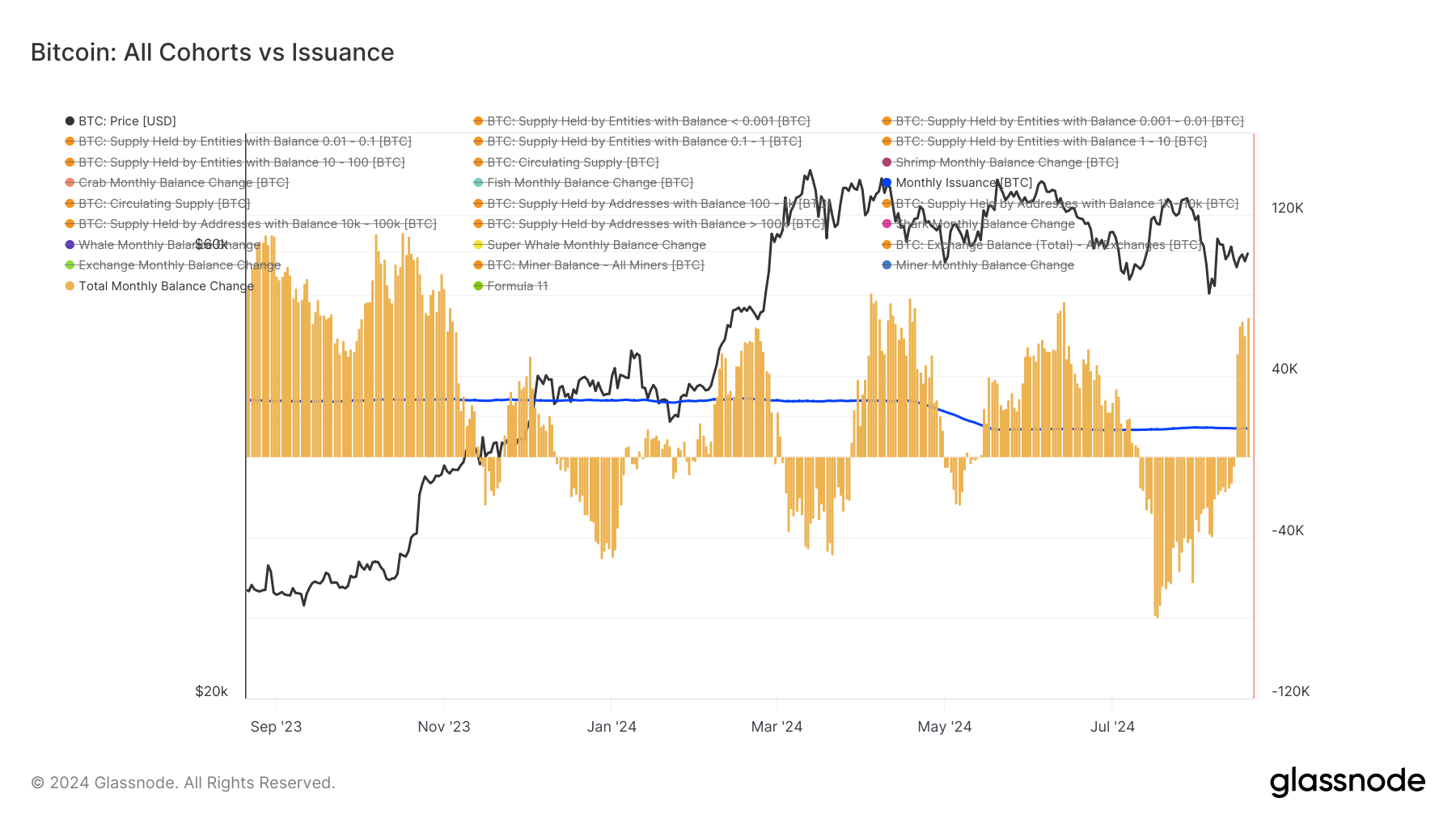

As of Aug. 20, the Bitcoin market is witnessing a significant shift towards net accumulation, with 70,000 BTC being accumulated across various cohorts over the past 30 days. CryptoSlate highlighted this trend on Aug. 7, which marked the highest accumulation since mid-June, when Bitcoin’s price hovered around $70,000.

The majority of Bitcoin holders, ranging from small investors (shrimps and crabs) to larger entities, are now in net accumulation, with the notable exception of super whales holding more than 100,000 BTC.

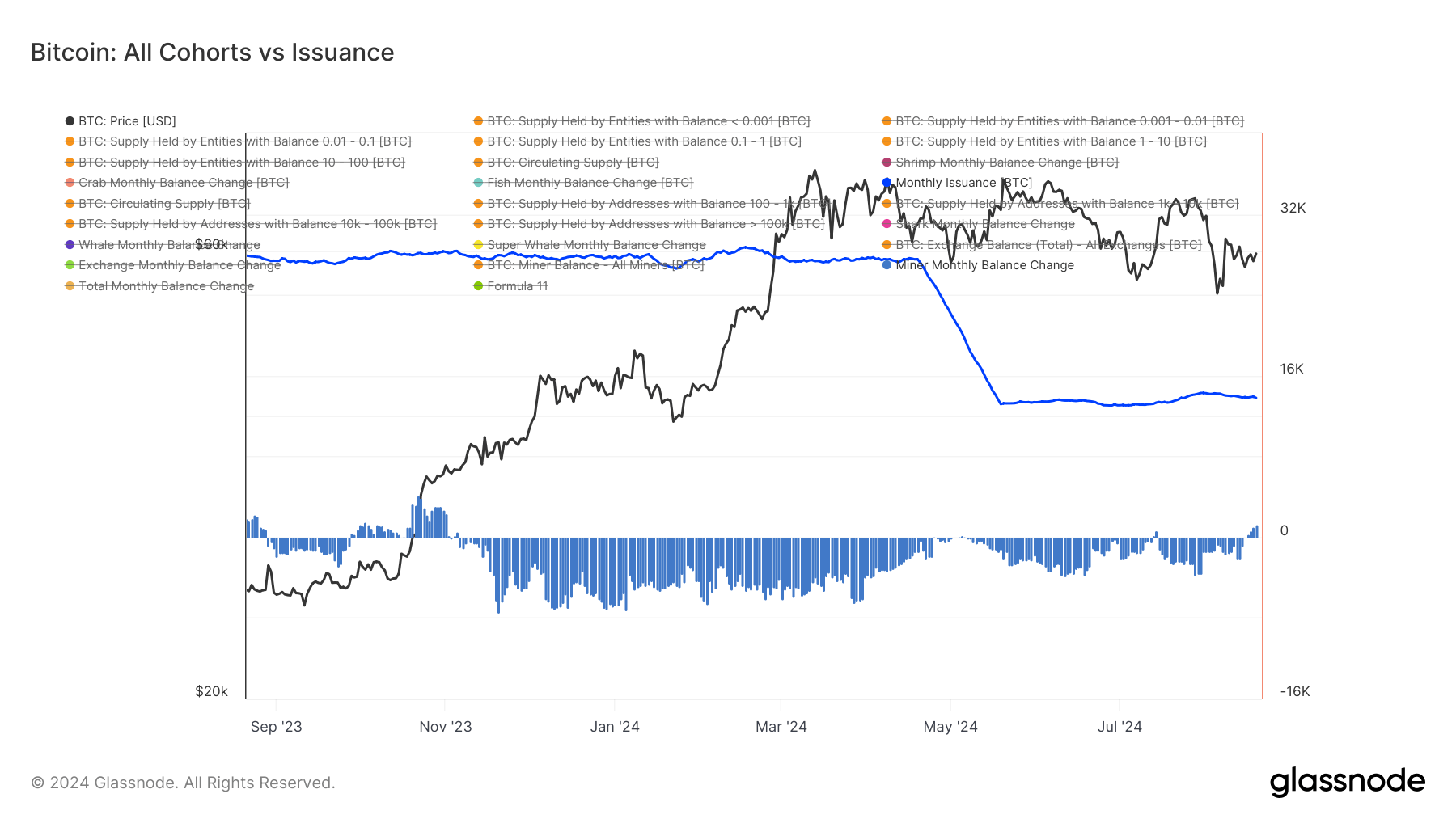

A particularly noteworthy development is the behavior of Bitcoin miners, who are now collectively in net accumulation — a trend not seen in nearly 12 months. This suggests a growing confidence in the long-term value of Bitcoin.

Additionally, the combined accumulation by smaller investors (shrimps and crabs) has reached levels last observed almost a year ago — highlighting increased participation and confidence from retail investors.

With Bitcoin’s monthly issuance at approximately 14,000 BTC, the current accumulation rate of 70,000 BTC is 5x higher than the monthly supply, indicating strong demand and potentially bullish market sentiment. This trend could have significant implications for Bitcoin’s price trajectory in the coming months.

The post Bitcoin accumulation surges as miners and retail investors show confidence appeared first on CryptoSlate.

from CryptoSlate https://ift.tt/AGr7QXj